Sports Sponsorships Tax Benefits: How to Maximize ROI for Your Business

August 25, 2025

August 25, 2025

In today’s environment of increasing tax pressure on businesses, sports sponsorships are not merely a marketing initiative.

They represent a powerful tool for financial planning.

Integrating sports and finance means leveraging instruments capable of generating measurable returns, both economically and reputationally.

Sports Sponsorships: Tax Benefits and Tangible Returns

From a regulatory perspective, sponsorship expenses are considered fully deductible costs (art. 90, L. 289/2002 for amateur sports associations, and general tax law under the principle of relevance for businesses).

In practice:

- €100,000 invested in sponsorships becomes a deductible expense with potential tax savings of up to 27%.

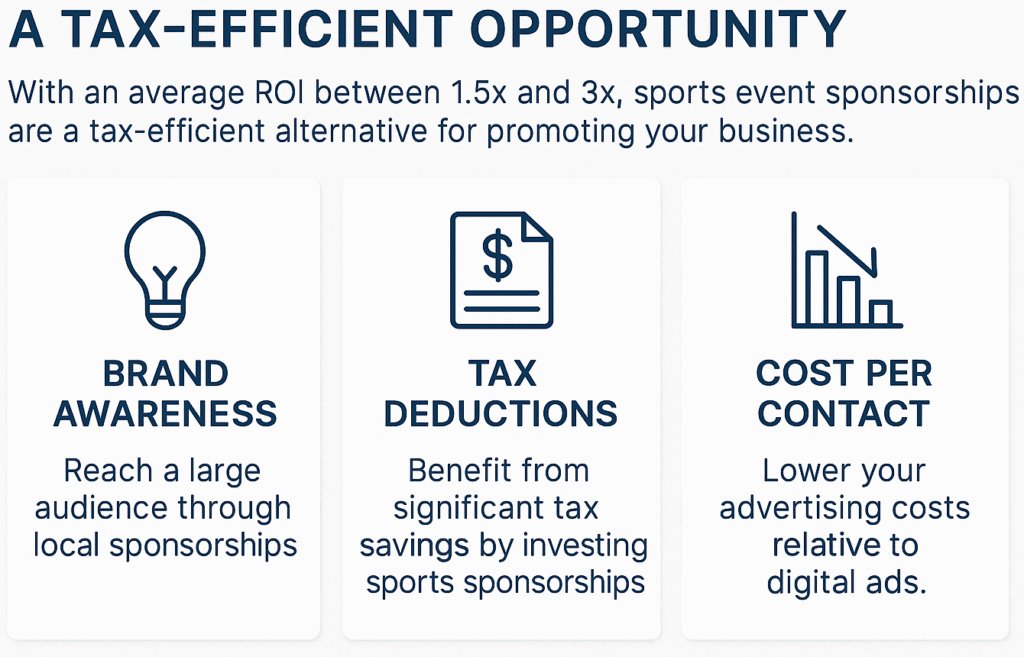

- At the same time, the same investment generates brand visibility and positioning returns, which can produce an average ROI between 1.5x and 3x compared to traditional media campaigns, thanks to the unique engagement sports are able to create.

In other words, the company transforms an expense into an investment with dual returns: economic and reputational.

Case Studies and Industry Benchmarks

- Local SMEs that invested in regional sponsorships (e.g., amateur football or basketball teams) reported a 20–25% increase in local brand awareness, with direct impact on their B2C business.

- B2B companies that sponsored niche sports events (e.g., golf, sailing, motorsports) achieved a 15% increase in qualified lead conversion, leveraging networking opportunities in exclusive contexts.

- Multinationals sponsoring mass sports events (e.g., marathons, running events, televised competitions) report that sports sponsorship delivers a 30% lower cost per contact (CPC) compared to digital advertising campaigns.

These benchmarks demonstrate how sports sponsorships can become a competitive asset.

The SBF Capital Approach: Integrating Sports and Finance

We have developed a unique approach that combines taxation and branding:

- Customized Planning – We analyze the company’s position to maximize efficiency in sponsorship spending.

- High-ROI Opportunity Scouting – We select disciplines and events aligned with brand positioning and target audience.

- Advanced KPI Measurement – We monitor metrics such as media exposure value, audience engagement rate, and incremental brand lift, ensuring that investments generate tangible returns.

- Integrated Strategy – We design sponsorships as a true investment vehicle, impacting both taxation and brand growth.

Why Sports Sponsorships Are a Unique Businesses Driver

Sports are a universal language: they unite people, territories, and markets, while instantly transmitting values such as trust, performance, and resilience.

Leveraging sports as both a fiscal and business lever means:

- Optimizing corporate taxation.

- Strengthening competitive positioning.

- Building emotional and value-driven bonds with clients, partners, and stakeholders.

💡 At SBF Capital, we believe the future of financial consulting lies in the ability to transform non-conventional instruments into powerful levers for growth and tax optimization.

👉 Discover how to use sports sponsorships to reduce your tax burden and increase your brand’s returns.

📨 Contact us for a first confidential and free assessment or visit our LinkedIn Page.

Categories

Recent News

Archives

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- January 2018

- December 2017